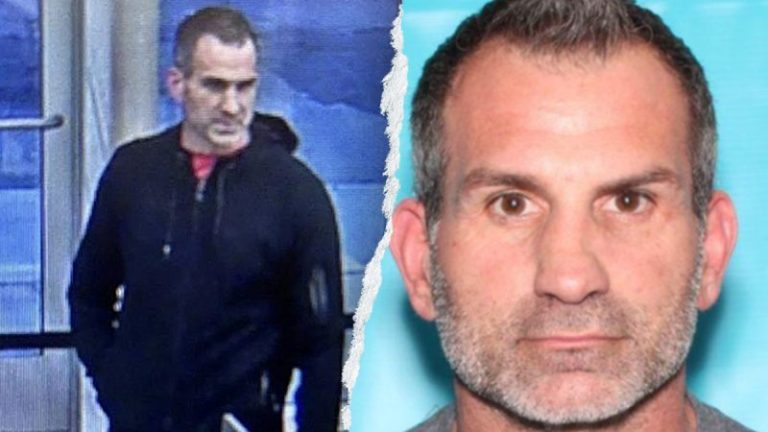

The FBI identified Keith Michael Lisa as the suspect wanted in connection to an attack this week on U.S. Attorney Alina Habba’s office.

A reward of up to $25,000 is being offered by the FBI for information leading to the arrest and conviction of Lisa.

‘Keith Michael Lisa is wanted for allegedly entering the Peter W. Rodino Federal Building in Newark, New Jersey, on November 12, 2025, while in possession of a bat,’ according to the FBI. ‘After being denied entry, he discarded the bat and returned. Once inside the building, he proceeded to the U.S. Attorney’s Office where he damaged government property.’

‘A federal arrest warrant was issued for Lisa on November 13, 2025, in the United States District Court for the District of New Jersey, Newark, New Jersey after he was charged with Possession of a Dangerous Weapon in a Federal Facility and Depredation of Federal Property,’ the FBI added.

Attorney General Pam Bondi announced Thursday that an individual attempted to confront Alina Habba on Wednesday night, ‘destroyed property in her office’ and then ‘fled the scene.’

‘Thankfully, Alina is ok,’ Bondi added. ‘Any violence or threats of violence against any federal officer will not be tolerated. Period. This is unfortunately becoming a trend as radicals continue to attack law enforcement agents around the country.’

Habba said following the incident that, ‘I will not be intimidated by radical lunatics for doing my job.’

Lisa, 51, is described by authorities as being around 6 feet 3 inches tall and weighing between 200 to 230 pounds.

The FBI said Lisa has ties to New York City and Mahwah, N.J., and ‘should be considered dangerous.’

On its website, the Justice Department said that as Acting U.S. Attorney and Special Attorney to the United States Attorney General, Habba ‘is responsible for overseeing all federal criminal prosecutions and the litigation of all civil matters in New Jersey in which the federal government has an interest.’

‘Including the offices in Newark, Camden, and Trenton, Ms. Habba supervises a staff of approximately 155 federal prosecutors and approximately 130 support personnel,’ according to the Justice Department.

Fox News’ Alexis McAdams contributed to this report.